It was another losing day but I learned a lot and some things are starting to sink in I believe. The importance of giving things enough room can't be understated. Giving things room over/under is important and giving things with big range at least 10% of its range for the day will also be a huge help going forward.

I don't have the exact executions with me so I'll try my best.

GIII: I had this on watch due to it gapping down on earnings and everything lined up as far as what I look for that told me it could continue lower. I shorted after it popped a bit and made a false breakout. It went lower but the part I messed up was instead of waiting for vwap to confirm as a peak (in hindsight I also should have waited for 34s to peak as well. Instead I thought it would flush at that instance so I added in and that was a bottom and from there it bounced and went straight up and stopped me out. I believe I stopped out of the add when it spiked and still kept the original, which was good, and then I got out when it made new highs. I then retried it on what I thought was the backside after a consolidation forming after having a peak put in and lower highs. It moved around a bit and while it spiked to my 35 over/under stop I was ok since I had small size. But then it went higher and I stopped out then which was near the top and from there it was straight down. So the lesson: On stocks like this give it 10% of its range, which is around 80-90 cents, so $1 about. So if I shorted $35 I should be ok with $36 over/under. And that would have been fine. In fact I could have added within my plan at around $36 after it had a good pattern forming up there. From there, I would have been ok and would have added at least at the consolidation level at the lows before the real flush. So going forward that will be a key thing for me. The other lesson is to always wait on adding - would you get in if you weren't already in?

CYOU: I had this on watch due to the overextended daily chart. I saw a very good pattern for a short so I went in although didn't get a good fill but it was a winner for a bit. I then added after it broke yesterday's afternoon support level, which was a bad idea of course, since that was a local bottom and it came right back up. My initial entry was to risk r/g over/under. Had I just stopped out of the add and kept the initial, I would have been in the stock and from there, would have enjoyed the move down to cover. I might not have added after that but it would have still been a win. So the lesson here is the same as with GIII: be true to stops and only stop out on add if need be but keep original as long as your stop isn't violated. Don't add at bad spots as well.

GNW: I had this on short watch due to it having an overextended daily chart. First I saw it drop vwap and thought about going in but I said I need to see it peak first. It never peaked and it reclaimed and went a bit higher before coming back down below it. This looked better so I got in but it never did much so I took it off for a tiny loss.

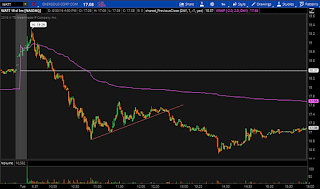

WATT: I had this on watch but thought it could higher. When today looked to be the fade day I kept it on watch for continued downside. I saw a nice bear flag forming and if it broke under it, I would short it. I was out on a walk while it triggered but it would have been a nice trade.

SPU: Didn't trade it unfortunately although I had very good reads on it from level 2 in the morning. I had a feeling that it would go up a bit then fade based on prior candles from VLTC when it had random one day pushes. A lot of people were being cautious shorting it I felt and saying it could go a lot farther and a lot of longs were complacent. This was a perfect short opportunity that I didn't take advantage of. I did think it would go a bit higher but when it made new highs and stalled on the level 2 I had a feeling that was it. I did try to short but it became HTB all of a sudden and by the time I borrowed I thought that was it. It did come back to test vwap and fail so I did try there as well but never got my fill. I thought about shorting it later on a few times but never did. I thought it would have to spook out shorts more intraday before the unwind.

Things to remember:

1. Trade the best

2. Give things enough room - over/under. If you like the trade enough then give it the full extent of your stop and on bigger rangers give it 10% of its daily range. Also average in if need be.

3. Don't add at bad spots with FOMO of missing out a big move. You get fucked this way. Better to just go in with your size from the get go and see what happens. Ask yourself - would you get in again if you weren't already?

No comments:

Post a Comment