Today was a good day. While it wasn't a monster green day, it was a green day nonetheless and my process was solid. I was very patient with stops and added at appropriate times. Nothing else to say really. I traded the best stocks. There were some ideas I had that would have worked and some that didn't.

BZUN: I had this on watch due to the overextended chart. I saw it pull red and under vwap which was a good sign based on prior days where it held vwap the entire day. So I started in and got a wash but was looking for a big picture idea so I wanted to add on a retest of the prior lows at the .20-.30 area. I added in when it looked to be rejecting at the time but it did go a bit higher. My stop for the add was .30 o/u. It did pop up through it but I held firm and I got the wash I was looking for. I took the first wash in case it bounced all the way back. It did end up washing more all the way to 12 but for now I have to lock in on things like this.

VEEV: I had this on watch due to earnings/guidance being good. I saw that prior times it pulls back and then goes back, possibly due to profit taking. After it fell off the highs, it consolidated and had a good pattern going. I drew a trendline and while I was debating getting in before the trendline broke, I didn't want to waste my time if it never broke it. After it broke and had a higher low, I got in with risk to 40 over/under. If held higher lows later so I added a little more. It really tested my patience and my ability to stick to my stop. My stop on the add was if it cracked the two prior lows above 40. It did do that so I got out of just the add, unfortunately that was a bottom. But I still held my initial. It did move around quite a bit and each time it looked like it was breaking out it came right back down. Eventually, it looked really good then came all the way back to my entry after stuffing at vwap. I just sold there for flat on the add. That too was also a bottom. It didn't do much afterwards but it did grind higher slowly. It wasn't worth it for this, I thought it would go back to 42. But either way it was a good process and entry. My stopping out could have been better but this was quite a tricky chart.

SPU: I thought this would be still stuck with shorts so I did chase small size when it looked good, but it didn't work at that particular time. They really worked over both sides until it decided to break out. I knew with the SSR on not to chase a potential breakout which is why I did it with small shares and was definitely not going to add. It did look like it was done afterwards on the level 2 but it never came and from there it had a nice pattern of holding up towards EOD that I saw but I didn't think it could do a lot in 10 min but I was wrong.

Things to work on:

1. Trade the best

2. Continue being better with being true to stop

A recap of my days at the market. The goal is to always do it right the first time, just like a hole in one.

Wednesday, August 31, 2016

Tuesday, August 30, 2016

Trading Recap 8/30/16

It was another losing day but I learned a lot and some things are starting to sink in I believe. The importance of giving things enough room can't be understated. Giving things room over/under is important and giving things with big range at least 10% of its range for the day will also be a huge help going forward.

I don't have the exact executions with me so I'll try my best.

GIII: I had this on watch due to it gapping down on earnings and everything lined up as far as what I look for that told me it could continue lower. I shorted after it popped a bit and made a false breakout. It went lower but the part I messed up was instead of waiting for vwap to confirm as a peak (in hindsight I also should have waited for 34s to peak as well. Instead I thought it would flush at that instance so I added in and that was a bottom and from there it bounced and went straight up and stopped me out. I believe I stopped out of the add when it spiked and still kept the original, which was good, and then I got out when it made new highs. I then retried it on what I thought was the backside after a consolidation forming after having a peak put in and lower highs. It moved around a bit and while it spiked to my 35 over/under stop I was ok since I had small size. But then it went higher and I stopped out then which was near the top and from there it was straight down. So the lesson: On stocks like this give it 10% of its range, which is around 80-90 cents, so $1 about. So if I shorted $35 I should be ok with $36 over/under. And that would have been fine. In fact I could have added within my plan at around $36 after it had a good pattern forming up there. From there, I would have been ok and would have added at least at the consolidation level at the lows before the real flush. So going forward that will be a key thing for me. The other lesson is to always wait on adding - would you get in if you weren't already in?

CYOU: I had this on watch due to the overextended daily chart. I saw a very good pattern for a short so I went in although didn't get a good fill but it was a winner for a bit. I then added after it broke yesterday's afternoon support level, which was a bad idea of course, since that was a local bottom and it came right back up. My initial entry was to risk r/g over/under. Had I just stopped out of the add and kept the initial, I would have been in the stock and from there, would have enjoyed the move down to cover. I might not have added after that but it would have still been a win. So the lesson here is the same as with GIII: be true to stops and only stop out on add if need be but keep original as long as your stop isn't violated. Don't add at bad spots as well.

GNW: I had this on short watch due to it having an overextended daily chart. First I saw it drop vwap and thought about going in but I said I need to see it peak first. It never peaked and it reclaimed and went a bit higher before coming back down below it. This looked better so I got in but it never did much so I took it off for a tiny loss.

WATT: I had this on watch but thought it could higher. When today looked to be the fade day I kept it on watch for continued downside. I saw a nice bear flag forming and if it broke under it, I would short it. I was out on a walk while it triggered but it would have been a nice trade.

SPU: Didn't trade it unfortunately although I had very good reads on it from level 2 in the morning. I had a feeling that it would go up a bit then fade based on prior candles from VLTC when it had random one day pushes. A lot of people were being cautious shorting it I felt and saying it could go a lot farther and a lot of longs were complacent. This was a perfect short opportunity that I didn't take advantage of. I did think it would go a bit higher but when it made new highs and stalled on the level 2 I had a feeling that was it. I did try to short but it became HTB all of a sudden and by the time I borrowed I thought that was it. It did come back to test vwap and fail so I did try there as well but never got my fill. I thought about shorting it later on a few times but never did. I thought it would have to spook out shorts more intraday before the unwind.

Things to remember:

1. Trade the best

2. Give things enough room - over/under. If you like the trade enough then give it the full extent of your stop and on bigger rangers give it 10% of its daily range. Also average in if need be.

3. Don't add at bad spots with FOMO of missing out a big move. You get fucked this way. Better to just go in with your size from the get go and see what happens. Ask yourself - would you get in again if you weren't already?

I don't have the exact executions with me so I'll try my best.

GIII: I had this on watch due to it gapping down on earnings and everything lined up as far as what I look for that told me it could continue lower. I shorted after it popped a bit and made a false breakout. It went lower but the part I messed up was instead of waiting for vwap to confirm as a peak (in hindsight I also should have waited for 34s to peak as well. Instead I thought it would flush at that instance so I added in and that was a bottom and from there it bounced and went straight up and stopped me out. I believe I stopped out of the add when it spiked and still kept the original, which was good, and then I got out when it made new highs. I then retried it on what I thought was the backside after a consolidation forming after having a peak put in and lower highs. It moved around a bit and while it spiked to my 35 over/under stop I was ok since I had small size. But then it went higher and I stopped out then which was near the top and from there it was straight down. So the lesson: On stocks like this give it 10% of its range, which is around 80-90 cents, so $1 about. So if I shorted $35 I should be ok with $36 over/under. And that would have been fine. In fact I could have added within my plan at around $36 after it had a good pattern forming up there. From there, I would have been ok and would have added at least at the consolidation level at the lows before the real flush. So going forward that will be a key thing for me. The other lesson is to always wait on adding - would you get in if you weren't already in?

CYOU: I had this on watch due to the overextended daily chart. I saw a very good pattern for a short so I went in although didn't get a good fill but it was a winner for a bit. I then added after it broke yesterday's afternoon support level, which was a bad idea of course, since that was a local bottom and it came right back up. My initial entry was to risk r/g over/under. Had I just stopped out of the add and kept the initial, I would have been in the stock and from there, would have enjoyed the move down to cover. I might not have added after that but it would have still been a win. So the lesson here is the same as with GIII: be true to stops and only stop out on add if need be but keep original as long as your stop isn't violated. Don't add at bad spots as well.

GNW: I had this on short watch due to it having an overextended daily chart. First I saw it drop vwap and thought about going in but I said I need to see it peak first. It never peaked and it reclaimed and went a bit higher before coming back down below it. This looked better so I got in but it never did much so I took it off for a tiny loss.

WATT: I had this on watch but thought it could higher. When today looked to be the fade day I kept it on watch for continued downside. I saw a nice bear flag forming and if it broke under it, I would short it. I was out on a walk while it triggered but it would have been a nice trade.

SPU: Didn't trade it unfortunately although I had very good reads on it from level 2 in the morning. I had a feeling that it would go up a bit then fade based on prior candles from VLTC when it had random one day pushes. A lot of people were being cautious shorting it I felt and saying it could go a lot farther and a lot of longs were complacent. This was a perfect short opportunity that I didn't take advantage of. I did think it would go a bit higher but when it made new highs and stalled on the level 2 I had a feeling that was it. I did try to short but it became HTB all of a sudden and by the time I borrowed I thought that was it. It did come back to test vwap and fail so I did try there as well but never got my fill. I thought about shorting it later on a few times but never did. I thought it would have to spook out shorts more intraday before the unwind.

Things to remember:

1. Trade the best

2. Give things enough room - over/under. If you like the trade enough then give it the full extent of your stop and on bigger rangers give it 10% of its daily range. Also average in if need be.

3. Don't add at bad spots with FOMO of missing out a big move. You get fucked this way. Better to just go in with your size from the get go and see what happens. Ask yourself - would you get in again if you weren't already?

Monday, August 29, 2016

Trading Recap 8/29/16

I could write about how stupid of a person I could be but that wouldn't help things. I could also write about how I broke every fucking rule I made and read to myself before the market opens but that wouldn't help anything either. The only thing that I can say that will help me actually follow these rules is the want to never feel as stupid and retarded as I do right now. All stocks traded today were red (even though a few I KNEW WHAT WOULD FUCKING HAPPEN) and I blew past my downside. That's it for the intro, there's nothing else to say and telling myself how much of a fucking idiot I am won't help either. This review won't help either since there are no other rules to learn. I know the rules but I need to actually follow them. Going forward honestly there won't be any point to reviews because I have every possible rule written down that covers essentially the important parts of trading and more. If I adhere to those, I will be successful and if I don't then I will fail.

MCUR: Going into the open I knew that there would be a lot of chasers who buy this up thinking this will be the next STEM and thus it will have a nice fade through the day - nothing happens two times in a row like this. Once everyone knew about STEM they went for the next possible ticker and that was it. THAT IS EXACTLY WHAT HAPPENED. Instead I shorted (surprised I could since we couldn't short stocks under $3 until today) and covered for tiny loss when it looked to be a trap. It then flushed and I wanted vwap tests to short and while they got close vwap, I was looking for a stuff through vwap and then fail for confirmation. That never came but there was volume around vwap around a few occasions but I never did anything with it afterward. THIS SETUP IS WHERE YOU EXCEL BUT YOU FUCKED UP. I'm not even mad about missing out in the morning because it did look trappish (probably why it worked).

BOFI: This had an overextended daily chart and while I missed the real play at the open but after it failed at the .70s it came back and I thought about shorting it on any signs of weakness since a lot of these overextended names have been fading farther than I thought. What did concern me though was that huge volume flush that was the bottom. But again lately those haven't been useful. So I drew an uptrendline and when it broke it to the downside I got in with risk to .40s o/u. This was the type of thing that should have worked right away but I wanted to be true to my stop as my rules outlined although this was one of those instances where it should have just worked. This was avoidable though as the uptrendline drawn wasn't a good one and I should have just waited for it to be under vwap first due to that huge flush.

UGAZ: I was interested in a short for a big picture fade due to the daily chart. In hindsight, these are the names where you average in and you have to be ok with building a position and then seeing what happens. Anyway, I saw a big volume candle but it wasn't a stuff. I thought fuck it and just went in and said to myself "it'll go down from here". If it was a stuff it should have worked right away (it wasn't a stuff to begin with) so I let it go up towards .50s o/u and stopped out in the .60s because I wanted to be true to my stop even though I knew as it was getting away from me that this wasn't it. I then saw it later in the day after the $42 double top and lower highs but I didn't make anything of it because it a was a thinly traded ETF at this point. I should have just done smaller size if I was so worried about it. ANOTHER STOCK YOU WERE RIGHT ABOUT BUT TRADED POORLY.

SPU: I saw this ripping and knew it was a former runner and it was day 1. I saw a failed breakout and went short in the 8s, added prematurely, covered for flat, then reshorted, added prematurely, then covered all within 5 minutes. I don't even know where to begin. How could I not follow my rule of not adding prematurely and it was day 1 (although EGLE faded on its first day but that was with a huge stuff). So after that clusterfuck it did fade a bit but I drew a trendline and it was consolidating (not peaking) under vwap and it seemed trappish for sure. I threw a bid but canceled it because I thought I was stupid for thinking I'd catch a move in this. It came back off a little and I thought that was it then it ramped and broke through vwap and I said oh that's interesting. Then it ripped up. Again something I "called" but never traded. But that wasn't even the worst thing. Later in the day I kept watching it and I saw it attempt to breakdown, collect shorts, and come back a bit. I thought it trapped shorts so I went long and added on the way up and then got so greedy that I added full size right at the highs in front of a huge ask and I thought "oh that's going to take some time to get through" and "maybe I should sell" but instead I stayed greedy and then it flushed and because I added at the highs and fucked up my average and was full size I took a decent hit when it wasn't a big drop at all but my stupidity caused a micro event like this to fuck me. I thought I was done with that but I guess not.

TWLO: I'm not even sure what to think about this one. I saw a good pattern for a fade and when it broke the base I shorted. I ended up bottom ticking the short (to the penny) and knew it should work right away but it retested 54 and I thought ok and it came back down but then ramped from there and while not really giving it to my full 54 o/u stop, I had shorted the bottom and knew the play wasn't going to work. The reason I shorted it is because TWLO has had some great fades on patterns like this recently but that was when it was coming off its highs. Now, it established itself a bit and actually I was looking for a weak open to get long in the morning but the gap up changed that. I then saw later in the day that it was going to break lows and I tried to short it but it was HTB by that point so the order didn't go through. Overall a stupid trade. Yeah it could have worked like all the other times but meh. Could I at least have waited for the retest? Yeah I thought about that but if it was going to fade like the others I knew it wouldn't retest, it would just keep fading. But if I am unsure then DON'T TAKE THE TRADE. When it retested my entry I didn't want to take it off because I didn't want to be scared out when it could still flush.

MCUR: Going into the open I knew that there would be a lot of chasers who buy this up thinking this will be the next STEM and thus it will have a nice fade through the day - nothing happens two times in a row like this. Once everyone knew about STEM they went for the next possible ticker and that was it. THAT IS EXACTLY WHAT HAPPENED. Instead I shorted (surprised I could since we couldn't short stocks under $3 until today) and covered for tiny loss when it looked to be a trap. It then flushed and I wanted vwap tests to short and while they got close vwap, I was looking for a stuff through vwap and then fail for confirmation. That never came but there was volume around vwap around a few occasions but I never did anything with it afterward. THIS SETUP IS WHERE YOU EXCEL BUT YOU FUCKED UP. I'm not even mad about missing out in the morning because it did look trappish (probably why it worked).

BOFI: This had an overextended daily chart and while I missed the real play at the open but after it failed at the .70s it came back and I thought about shorting it on any signs of weakness since a lot of these overextended names have been fading farther than I thought. What did concern me though was that huge volume flush that was the bottom. But again lately those haven't been useful. So I drew an uptrendline and when it broke it to the downside I got in with risk to .40s o/u. This was the type of thing that should have worked right away but I wanted to be true to my stop as my rules outlined although this was one of those instances where it should have just worked. This was avoidable though as the uptrendline drawn wasn't a good one and I should have just waited for it to be under vwap first due to that huge flush.

UGAZ: I was interested in a short for a big picture fade due to the daily chart. In hindsight, these are the names where you average in and you have to be ok with building a position and then seeing what happens. Anyway, I saw a big volume candle but it wasn't a stuff. I thought fuck it and just went in and said to myself "it'll go down from here". If it was a stuff it should have worked right away (it wasn't a stuff to begin with) so I let it go up towards .50s o/u and stopped out in the .60s because I wanted to be true to my stop even though I knew as it was getting away from me that this wasn't it. I then saw it later in the day after the $42 double top and lower highs but I didn't make anything of it because it a was a thinly traded ETF at this point. I should have just done smaller size if I was so worried about it. ANOTHER STOCK YOU WERE RIGHT ABOUT BUT TRADED POORLY.

SPU: I saw this ripping and knew it was a former runner and it was day 1. I saw a failed breakout and went short in the 8s, added prematurely, covered for flat, then reshorted, added prematurely, then covered all within 5 minutes. I don't even know where to begin. How could I not follow my rule of not adding prematurely and it was day 1 (although EGLE faded on its first day but that was with a huge stuff). So after that clusterfuck it did fade a bit but I drew a trendline and it was consolidating (not peaking) under vwap and it seemed trappish for sure. I threw a bid but canceled it because I thought I was stupid for thinking I'd catch a move in this. It came back off a little and I thought that was it then it ramped and broke through vwap and I said oh that's interesting. Then it ripped up. Again something I "called" but never traded. But that wasn't even the worst thing. Later in the day I kept watching it and I saw it attempt to breakdown, collect shorts, and come back a bit. I thought it trapped shorts so I went long and added on the way up and then got so greedy that I added full size right at the highs in front of a huge ask and I thought "oh that's going to take some time to get through" and "maybe I should sell" but instead I stayed greedy and then it flushed and because I added at the highs and fucked up my average and was full size I took a decent hit when it wasn't a big drop at all but my stupidity caused a micro event like this to fuck me. I thought I was done with that but I guess not.

TWLO: I'm not even sure what to think about this one. I saw a good pattern for a fade and when it broke the base I shorted. I ended up bottom ticking the short (to the penny) and knew it should work right away but it retested 54 and I thought ok and it came back down but then ramped from there and while not really giving it to my full 54 o/u stop, I had shorted the bottom and knew the play wasn't going to work. The reason I shorted it is because TWLO has had some great fades on patterns like this recently but that was when it was coming off its highs. Now, it established itself a bit and actually I was looking for a weak open to get long in the morning but the gap up changed that. I then saw later in the day that it was going to break lows and I tried to short it but it was HTB by that point so the order didn't go through. Overall a stupid trade. Yeah it could have worked like all the other times but meh. Could I at least have waited for the retest? Yeah I thought about that but if it was going to fade like the others I knew it wouldn't retest, it would just keep fading. But if I am unsure then DON'T TAKE THE TRADE. When it retested my entry I didn't want to take it off because I didn't want to be scared out when it could still flush.

CNAT: I saw bids absorb on this news play so I went long with size but when it couldn't get past the highs right away I ditched it for a tiny loss. It was weird as both sides were fighting one another and no one was winning for a while so I stayed away.

CXW: I shorted this after the bounce because I heard that some firm came and defended it but I thought that the bounce was weak and after the inevitable defense that it would go lower. I also it a tiny breakout from consolidation and reject so I shorted that. In the same minute I stopped out as it spiked higher. Lesson: Just have a fucking thesis and don't go in with a microscope to see if it went a penny above some resistance to short into. Yeah you thought the firm defended it and that was it but meh. If it worked I guess I would be saying it was a great trade so who knows.

Things to remember:

1. You suck.

2. Everything in that binder that you read before the market opens. Had you 1. not added prematurely 2. not gotten FOMO 3. only traded the best (MCUR and SPU) 3. given big picture room on UGAZ - your day would have been massively green instead of massively red.

Saturday, August 27, 2016

Trading Recap 8/26/16

It was a mixed day for me. There were some good parts and bad parts and at the end of the day I had a loss for the day but nothing big. The one loser in the afternoon that knocked me from green on the day to red I originally called a stupid trade. Maybe it was but the main reason I called it stupid was because it didn't work. A trade can't be stupid if you followed your plan and liked something and went for it. If you followed your plan and rules it should be fine. There was an element of FOMO within that trade, which was the main bad thing about it.

GME: This was my first trade for the day. I was short biased due to earnings being poor. It wasn't the best setup but if it had a proper setup then my plan was to short lower highs. Since it was near the open, I wanted to give it room to work and then add after confirmation of trend. So I started in really small and my risk was to 30.50s o/u. It did spike to it but I wasn't worried at all due to small size. It looked like it stuffed a bit into it so I added after the stuff. It came back down but what I saw was a pattern of it holding that .80 level and it tried to snap it bug then came back and recollected. This was a similar pattern to ACIA when I covered so at this point I just covered it for flat. It did screw around in that area for a bit but then later there were good points to short it that I hadn't seen. I think the covering and being safe was ok because it did screw around for a bit and I don't like getting chopped up. Had I seen the pattern on this and wasn't focused on other stocks, I probably would have taken it. Positives: Started in small, didn't get spooked because of small size and letting things play out, added when I thought it was good, covered when I was unsure. The cover doesn't look as good since the trade eventually ended up working but I avoided the chop and it could have gone higher too.

DG: I was interested in this on pops for continued fading. In the morning I saw that it tried to breakout from the little flag it created and it popped through it but then immediately got slammed back so I thought on a retest of the prior resistance, it would be a good entry. I was going to do small size in case it needed room. I shorted in the low 76s in anticipation of that area becoming resistance. In real time it looked like that was it vs. what the candles look like now so I thought that was it but then it caught itself and came back and made new highs. I didn't panic out and it made new highs but then came right back down so I added here with the thought that was it. Unfortunately, it did go higher so I stopped out on my total position. Looking at the chart, 77 was a major level. However, even if I had risked off of that I might have covered near the top anyway since that is where it looked to be holding. Later in the day, I saw it have lower highs and it looked like the backside, I never reshorted it unfortunately even though it did look good. I need to do a better job of getting in in these scenarios. Positives: I waited for what I thought was a pattern and in real time it looked good but I gave it space to work too and wasn't afraid to add higher when I thought it had a false breakout. While I wouldn't have wanted to risk all the way to 77 since the r:r would be out of whack for me, I should have went in on the backside of the move when it looked good.

MOMO: I had this on long watch for any higher lows. In the morning I let it do its thing and flush everybody out. I didn't want to buy any washouts but I wanted it to prove itself first. I saw it reclaim vwap and decided to get in there. When it went green and made nHOD I thought I wouldn't get a dip in this to add so I added again. It worked out and I got the initial runup. I know this stock can be fickle so I took the gains. However, it re setup again and looked good for another push so I longed it again small and then added when it looked poised to breakout. It went up a few cents and then consolidated for a minute or two and when it broke from there I doubled in and when it went towards $22 and couldn't get past it I sold at 21.90. Overall great trade and these are the types that just go and won't offer you a dip chance to add. I thought about relonging it when I saw an abcd form but decided against it. It could have worked but I thought that was it and I know that it can be a fickle stock as mentioned. Positives: I let the patterns form in the morning and didn't get involved too early and avoided dealing with that washout. I got in for the move and added higher because I thought it looekd good and that it would just go straight up without any dips. After I sold I relonged it with the same amount of shares and while it was sort of a chase, it did look good for the squeeze potential. Again I added higher because it just went straight up and sold when the trend looked to change. Perhaps I didn't get in again with the ABCD due to fear but it's ok.

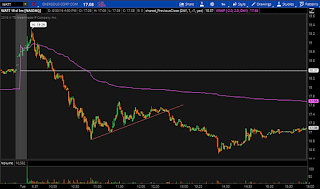

REN: Before I write about this trade, looking back at the chart I should have charted it better with the major area of prior support from around 16.50 to 17. So if I am shorting it I have to be ok with 17 o/u since my thesis for the trade was that it broke down finally and any pops to that prior level was ok. For some reason I put the resistance line at 16.80 only which makes a huge difference for the way I trade. Anyway, I originally thought that it went through the resistance and failed so I shorted the next pop but was eventually taken out as it went higher (right to the higher resistance area at 17ish which is where I would have anticipated it going since it likes to fuck shorts). Positives: Waited for pop to short Negatives: Didn't chart it properly otherwise I would have shorted after lower high to 17 and it wold have been a winner. Also based on where I covered it was stupid because I should have risked to new highs or 17 o/u. I got scared because of what it can do quickly but overall it was a bad trade like some of my prior ones this week where I get out near the top due to being fear and not giving it enough room.

YRD: Maybe a stupid trade but given the beatdown chart and the fact that it reclaimed the support from yesterday and was consolidating and looked like an ABCD I thought it was good for continued move higher. I bought when volume started to come in and it started to push but that looked like a huge stuff so I got out right away for a very tiny loss since I had small size. I left it alone afterwards, it flushed, came back, and then went a little higher but then did nothing. I think it was better to be safe than sorry in this case because it looked like it stuffed pretty hard in realtime. If it setup again I could always get back in.

UGAZ: What a missed opportunity. I was looking at it for a reversal back down but left it alone for most of the day. I then saw it stuff pretty big and thought about shorting there since the daily was getting extended and the fact that it stuffed like that was a good indicator it could have a late day fade. I didn't get in around that area unfortunately but I saw it retest, try to breakout from the 42 area and fail, so I got in then. It dropped but then looked like it quickly reclaimed that 50s o/u area so I got out for flat when I could. I ended up topticking that candle and it was all down from there and there were spots to add as well for the EOD fade that I completely missed. I did think about getting in again at certain spots again but decided against it because I would have shorted support and looking at the NG futures, that initial drop was on huge volume so I thought that might have been it for the fade but it wasn't. As mentioned in the LABU post, sometimes huge volume flushes are the end and sometimes they aren't but the r:r at this point wasn't worth it. Positives: I waited for it to push to 42 and fail to get in. Negatives: Fear came in and I got out for flat on a position that would have been a great profit.

SPY: This was the stupid trade I had referenced in the intro. Looking back again though, it did seem like a stupid trade and FOMO definitely came into play where I didn't want to miss out on another fade in the market. While there was pattern to it I liked, it wasn't really that good of a setup. I ended up bottom ticking the short for what ended up being a higher low instead of waiting for a retest to the resistance for an entry. It went past resistance and since that was my over/under area I stopped out.

STJ: This had news and while I usually don't play these this had some pretty clear price action that I took advantage of although I gave it back with my last trade on it which was the only one I ended up adding into. I ended up $1 on the name. Nothing to post here since it was just price action on the L2 with bids absorbing and not being able to get through certain levels etc.

Things to work on:

1. Continue giving things room to work and then adding on confirmation or better price points.

2. Keep things on watch throughout the day as they can setup better for the real move (GME/DG)

3. No FOMO

4. Chart lines better

5. If you are going to take a trade, give it the full out unless something materially changes. YRD for example it stuffed pretty hard so I got out. But UGAZ is a thinly traded ETF so it will have these random moves like LABU that you need to be patient with.

6. Don't trade PnL when you are up just because you want to be up on the day and not take a loser. That is mainly why you didn't want to take a potential loss when it came back. While it looked like it just flushed and reclaimed, on ETFs like this you have to be more patient.

GME: This was my first trade for the day. I was short biased due to earnings being poor. It wasn't the best setup but if it had a proper setup then my plan was to short lower highs. Since it was near the open, I wanted to give it room to work and then add after confirmation of trend. So I started in really small and my risk was to 30.50s o/u. It did spike to it but I wasn't worried at all due to small size. It looked like it stuffed a bit into it so I added after the stuff. It came back down but what I saw was a pattern of it holding that .80 level and it tried to snap it bug then came back and recollected. This was a similar pattern to ACIA when I covered so at this point I just covered it for flat. It did screw around in that area for a bit but then later there were good points to short it that I hadn't seen. I think the covering and being safe was ok because it did screw around for a bit and I don't like getting chopped up. Had I seen the pattern on this and wasn't focused on other stocks, I probably would have taken it. Positives: Started in small, didn't get spooked because of small size and letting things play out, added when I thought it was good, covered when I was unsure. The cover doesn't look as good since the trade eventually ended up working but I avoided the chop and it could have gone higher too.

DG: I was interested in this on pops for continued fading. In the morning I saw that it tried to breakout from the little flag it created and it popped through it but then immediately got slammed back so I thought on a retest of the prior resistance, it would be a good entry. I was going to do small size in case it needed room. I shorted in the low 76s in anticipation of that area becoming resistance. In real time it looked like that was it vs. what the candles look like now so I thought that was it but then it caught itself and came back and made new highs. I didn't panic out and it made new highs but then came right back down so I added here with the thought that was it. Unfortunately, it did go higher so I stopped out on my total position. Looking at the chart, 77 was a major level. However, even if I had risked off of that I might have covered near the top anyway since that is where it looked to be holding. Later in the day, I saw it have lower highs and it looked like the backside, I never reshorted it unfortunately even though it did look good. I need to do a better job of getting in in these scenarios. Positives: I waited for what I thought was a pattern and in real time it looked good but I gave it space to work too and wasn't afraid to add higher when I thought it had a false breakout. While I wouldn't have wanted to risk all the way to 77 since the r:r would be out of whack for me, I should have went in on the backside of the move when it looked good.

MOMO: I had this on long watch for any higher lows. In the morning I let it do its thing and flush everybody out. I didn't want to buy any washouts but I wanted it to prove itself first. I saw it reclaim vwap and decided to get in there. When it went green and made nHOD I thought I wouldn't get a dip in this to add so I added again. It worked out and I got the initial runup. I know this stock can be fickle so I took the gains. However, it re setup again and looked good for another push so I longed it again small and then added when it looked poised to breakout. It went up a few cents and then consolidated for a minute or two and when it broke from there I doubled in and when it went towards $22 and couldn't get past it I sold at 21.90. Overall great trade and these are the types that just go and won't offer you a dip chance to add. I thought about relonging it when I saw an abcd form but decided against it. It could have worked but I thought that was it and I know that it can be a fickle stock as mentioned. Positives: I let the patterns form in the morning and didn't get involved too early and avoided dealing with that washout. I got in for the move and added higher because I thought it looekd good and that it would just go straight up without any dips. After I sold I relonged it with the same amount of shares and while it was sort of a chase, it did look good for the squeeze potential. Again I added higher because it just went straight up and sold when the trend looked to change. Perhaps I didn't get in again with the ABCD due to fear but it's ok.

REN: Before I write about this trade, looking back at the chart I should have charted it better with the major area of prior support from around 16.50 to 17. So if I am shorting it I have to be ok with 17 o/u since my thesis for the trade was that it broke down finally and any pops to that prior level was ok. For some reason I put the resistance line at 16.80 only which makes a huge difference for the way I trade. Anyway, I originally thought that it went through the resistance and failed so I shorted the next pop but was eventually taken out as it went higher (right to the higher resistance area at 17ish which is where I would have anticipated it going since it likes to fuck shorts). Positives: Waited for pop to short Negatives: Didn't chart it properly otherwise I would have shorted after lower high to 17 and it wold have been a winner. Also based on where I covered it was stupid because I should have risked to new highs or 17 o/u. I got scared because of what it can do quickly but overall it was a bad trade like some of my prior ones this week where I get out near the top due to being fear and not giving it enough room.

YRD: Maybe a stupid trade but given the beatdown chart and the fact that it reclaimed the support from yesterday and was consolidating and looked like an ABCD I thought it was good for continued move higher. I bought when volume started to come in and it started to push but that looked like a huge stuff so I got out right away for a very tiny loss since I had small size. I left it alone afterwards, it flushed, came back, and then went a little higher but then did nothing. I think it was better to be safe than sorry in this case because it looked like it stuffed pretty hard in realtime. If it setup again I could always get back in.

UGAZ: What a missed opportunity. I was looking at it for a reversal back down but left it alone for most of the day. I then saw it stuff pretty big and thought about shorting there since the daily was getting extended and the fact that it stuffed like that was a good indicator it could have a late day fade. I didn't get in around that area unfortunately but I saw it retest, try to breakout from the 42 area and fail, so I got in then. It dropped but then looked like it quickly reclaimed that 50s o/u area so I got out for flat when I could. I ended up topticking that candle and it was all down from there and there were spots to add as well for the EOD fade that I completely missed. I did think about getting in again at certain spots again but decided against it because I would have shorted support and looking at the NG futures, that initial drop was on huge volume so I thought that might have been it for the fade but it wasn't. As mentioned in the LABU post, sometimes huge volume flushes are the end and sometimes they aren't but the r:r at this point wasn't worth it. Positives: I waited for it to push to 42 and fail to get in. Negatives: Fear came in and I got out for flat on a position that would have been a great profit.

SPY: This was the stupid trade I had referenced in the intro. Looking back again though, it did seem like a stupid trade and FOMO definitely came into play where I didn't want to miss out on another fade in the market. While there was pattern to it I liked, it wasn't really that good of a setup. I ended up bottom ticking the short for what ended up being a higher low instead of waiting for a retest to the resistance for an entry. It went past resistance and since that was my over/under area I stopped out.

STJ: This had news and while I usually don't play these this had some pretty clear price action that I took advantage of although I gave it back with my last trade on it which was the only one I ended up adding into. I ended up $1 on the name. Nothing to post here since it was just price action on the L2 with bids absorbing and not being able to get through certain levels etc.

Things to work on:

1. Continue giving things room to work and then adding on confirmation or better price points.

2. Keep things on watch throughout the day as they can setup better for the real move (GME/DG)

3. No FOMO

4. Chart lines better

5. If you are going to take a trade, give it the full out unless something materially changes. YRD for example it stuffed pretty hard so I got out. But UGAZ is a thinly traded ETF so it will have these random moves like LABU that you need to be patient with.

6. Don't trade PnL when you are up just because you want to be up on the day and not take a loser. That is mainly why you didn't want to take a potential loss when it came back. While it looked like it just flushed and reclaimed, on ETFs like this you have to be more patient.

Thursday, August 25, 2016

Trading Recap 8/25/16

Today I was the comeback kid. While today was exhausting, it didn't have to be and while I am glad I made my initial losses back, but going forward I'll implement some things that will take my trading to the next level for sure and I am glad I didn't have to pay too much for the lessons. I was a $1 away from my downside and not being able to enter any more positions but then I made it all back in one trade and was flat (up $0.2).

CLVS: I thought this could continue lower due to the news not being that important and a lot of longs who got in will want to sell after no followthrough so I was looking for any lower highs/stuffs to get into it and add. I saw it ramp up and then stall at .40 level so I started in there with risk to 40s o/u. After it flushed a little I added when it looked to have a lower high and was peaking vwap. It came back and then I covered the add and then I covered the initial when it looked like it was going to nHOD. First mistake: Covering the add was fine since I was risking vwap/23 o/u but covering the initial due to fear was a mistake. As you will see I could have kept that on the rest of the time and then added for the eventual breakdown when it did happen. Anyway, after it came back down I thought now it could go lower after it got me and probably other shorts out so I shorted when it looked to be peaking vwap again and then when it broke through .80s I added on the breakdown because I didn't want to miss out on the flush with some added size. Mistake #2: Can't impose your will on the market so whatever size you can get in at proper entries then so be it. Adding on the breakdown can work but has fucked you a lot in the past so don't do it and wait for any pops. After I added at the lows, it came back and then ripped higher and I got out completely again. I then missed the actual move lower. What should have happened was I had that first initial position, adding was fine but then when I cover the add, the original's stop was never invalidated so keep that on throughout the chop and then add when it really drops. The key lesson here is twofold: give things enough room and don't add at inappropriate spots. Adding into weakness can work but best to just get in on pops, unless the situation warrants it. This is the type of stock to fuck traders vs. other stocks that just breakdown so shorting strength is the only option.

YRD: I was looking for a bounce in this stock due to the heavy selling and large volume on the prior day. I was looking for higher lows to get in since I didn't want to pick a bottom. It started washing out and I waited for an entry. It then went a decent amount off the lows but I didn't want to chase so I waited for a proper entry. I then saw it holding around the .50 level so I got in around there. I had really small size so I should have just risked to new lows but I just gave it to .50 o/u. I held through a few times that it cracked .50 but then came back but then when it went a bit lower than the past few times I sold out, since I didn't have much confidence in it at this point... and I bottom ticked the low and the candle. It then proceeded to slowly grind up and then go nuts all without me. Again the lesson is the same as above with CLVS: give things room to work with and then tighten it with proper adds and only stop out on adds and not the entire position unless the setup warrants it.

NYMX: I was looking to short this but was unsure how high it would go due to a lot of shorts being in this and the fact that a lot of people probably shorted after the Adam F tweet and might get stuck if it goes higher. So I was willing to be patient with it. I saw it had failed to breakdown below 5 and was probably trapping shorts and thought about going long but decided that wasn't the plan and I wasn't completely sure about that anyway. I did try to get in short before that when it looked like it stuffed but canceled as I didn't get filled at a good price. After it went up and down for a bit I thought it looked weak so I shorted at 5.1 after teh vwap fail and my plan was to add on pops under 5. It fell under $5 and I wanted a retest. It went low pretty quickly but I didn't want to miss out on the big flush. Sound familiar? So instead of waiting for a $5 retest which I knew would happen on this stock with a bunch of shorts, I decided to randomly add in to 3/4 size at the lows at 4.80. It then ripped up to $5ish and of course now my winner was a loser but I added in a last 1/4 because I was confident. However, I failed to see that it reclaimed the $4.9 level from earlier because then it ripped past 5 and squeezed me out and that was it. I thought about shorting it later in the day but decided against it. Overall had I waited to short $5 I would have been in better shape. I'm not sure how I would have played it from there but at the least the loss would be a lot less. Lesson: Don't chase the add and be patient per your plan.

LABU: At this point I was down $49 and had one trade left essentially. I saw a tweet that LABU looked good for a short and I checked it out and the pattern looked very familiar to when TWLO tanked so I just went in with 50 shares and said fuck it. I almost covered at the top of the retest since it went a bit higher than I thought but I said fuck it and let it ride. I got an awesome wash and I covered into the wash with the big volume candle. I thought that would be it since it had huge volume but that was only the beginning. It is unfortunate I covered too soon but a lot of times those flushes are it so it's give and take. I thought about reshorting pops on the downtrend but decided against since I made back my day and wasn't too confident in it, although it would have worked. Looking back though, while the volume was a lot it wasn't a huge amount like yesterday that marked the low. It looked big on the 1min timeframe but on others not so much. Other stocks though the 1min volume works so it really depends. I thought about adding in as it was about to go red but decided not to due to SSR being on and my rules as described above.

Things to work on:

1. Give things enough room and don't add at inappropriate spots. Don't stop out of the initial position even if you stop out of the add unless the initial position's stop is hit. Be patient with adding. Think would you get in at that spot if you were never in it in the first place?

2. Sometimes big volume doesn't mean it is the bottom. Maybe cover 1/2 or 3/4 and let rest ride?

3. Know when you can break the rule of only shorting pops and when it is ok to add on weakness and vice versa for longs.

CLVS: I thought this could continue lower due to the news not being that important and a lot of longs who got in will want to sell after no followthrough so I was looking for any lower highs/stuffs to get into it and add. I saw it ramp up and then stall at .40 level so I started in there with risk to 40s o/u. After it flushed a little I added when it looked to have a lower high and was peaking vwap. It came back and then I covered the add and then I covered the initial when it looked like it was going to nHOD. First mistake: Covering the add was fine since I was risking vwap/23 o/u but covering the initial due to fear was a mistake. As you will see I could have kept that on the rest of the time and then added for the eventual breakdown when it did happen. Anyway, after it came back down I thought now it could go lower after it got me and probably other shorts out so I shorted when it looked to be peaking vwap again and then when it broke through .80s I added on the breakdown because I didn't want to miss out on the flush with some added size. Mistake #2: Can't impose your will on the market so whatever size you can get in at proper entries then so be it. Adding on the breakdown can work but has fucked you a lot in the past so don't do it and wait for any pops. After I added at the lows, it came back and then ripped higher and I got out completely again. I then missed the actual move lower. What should have happened was I had that first initial position, adding was fine but then when I cover the add, the original's stop was never invalidated so keep that on throughout the chop and then add when it really drops. The key lesson here is twofold: give things enough room and don't add at inappropriate spots. Adding into weakness can work but best to just get in on pops, unless the situation warrants it. This is the type of stock to fuck traders vs. other stocks that just breakdown so shorting strength is the only option.

YRD: I was looking for a bounce in this stock due to the heavy selling and large volume on the prior day. I was looking for higher lows to get in since I didn't want to pick a bottom. It started washing out and I waited for an entry. It then went a decent amount off the lows but I didn't want to chase so I waited for a proper entry. I then saw it holding around the .50 level so I got in around there. I had really small size so I should have just risked to new lows but I just gave it to .50 o/u. I held through a few times that it cracked .50 but then came back but then when it went a bit lower than the past few times I sold out, since I didn't have much confidence in it at this point... and I bottom ticked the low and the candle. It then proceeded to slowly grind up and then go nuts all without me. Again the lesson is the same as above with CLVS: give things room to work with and then tighten it with proper adds and only stop out on adds and not the entire position unless the setup warrants it.

NYMX: I was looking to short this but was unsure how high it would go due to a lot of shorts being in this and the fact that a lot of people probably shorted after the Adam F tweet and might get stuck if it goes higher. So I was willing to be patient with it. I saw it had failed to breakdown below 5 and was probably trapping shorts and thought about going long but decided that wasn't the plan and I wasn't completely sure about that anyway. I did try to get in short before that when it looked like it stuffed but canceled as I didn't get filled at a good price. After it went up and down for a bit I thought it looked weak so I shorted at 5.1 after teh vwap fail and my plan was to add on pops under 5. It fell under $5 and I wanted a retest. It went low pretty quickly but I didn't want to miss out on the big flush. Sound familiar? So instead of waiting for a $5 retest which I knew would happen on this stock with a bunch of shorts, I decided to randomly add in to 3/4 size at the lows at 4.80. It then ripped up to $5ish and of course now my winner was a loser but I added in a last 1/4 because I was confident. However, I failed to see that it reclaimed the $4.9 level from earlier because then it ripped past 5 and squeezed me out and that was it. I thought about shorting it later in the day but decided against it. Overall had I waited to short $5 I would have been in better shape. I'm not sure how I would have played it from there but at the least the loss would be a lot less. Lesson: Don't chase the add and be patient per your plan.

LABU: At this point I was down $49 and had one trade left essentially. I saw a tweet that LABU looked good for a short and I checked it out and the pattern looked very familiar to when TWLO tanked so I just went in with 50 shares and said fuck it. I almost covered at the top of the retest since it went a bit higher than I thought but I said fuck it and let it ride. I got an awesome wash and I covered into the wash with the big volume candle. I thought that would be it since it had huge volume but that was only the beginning. It is unfortunate I covered too soon but a lot of times those flushes are it so it's give and take. I thought about reshorting pops on the downtrend but decided against since I made back my day and wasn't too confident in it, although it would have worked. Looking back though, while the volume was a lot it wasn't a huge amount like yesterday that marked the low. It looked big on the 1min timeframe but on others not so much. Other stocks though the 1min volume works so it really depends. I thought about adding in as it was about to go red but decided not to due to SSR being on and my rules as described above.

NUGT: I missed the wash and higher low trade in NUGT since there weren't really any higher lows after it bounced. After it started pulling back though, it consolidated and had a decent looking pattern so I shorted and it did breakdown but then came right back and I got out for flat. While I could have risked to that level o/u, I didn't want any headaches after coming all the way back to green.

Things to work on:

1. Give things enough room and don't add at inappropriate spots. Don't stop out of the initial position even if you stop out of the add unless the initial position's stop is hit. Be patient with adding. Think would you get in at that spot if you were never in it in the first place?

2. Sometimes big volume doesn't mean it is the bottom. Maybe cover 1/2 or 3/4 and let rest ride?

3. Know when you can break the rule of only shorting pops and when it is ok to add on weakness and vice versa for longs.

Wednesday, August 24, 2016

Trading Recap 8/24/16

Today I learned a lot and I was also up on the day as well after almost hitting my downside in the morning after some trades. It seems I broke the pattern of me hitting my downside the past two Wednesdays in a row although it was certainly going that way in the morning before I grinded out to positive.

CLVS: I was short biased going into the day due to the news not being worth the huge gap and the fact that I thought a lot of longs would be bagged. I also thought that if I was a longterm short in this name I wouldn't bother covering yet just due to this news. My plan was if I saw any stuffs/lower highs to get in and it wasn't something I was willing to average into due to the fact that it could just keep going higher in case a squeeze was on. I entered my position prematurely and partly due to FOMO and broke my rules for my plan by going in when vwap was looking to be the peak at the open, which is definitely not a reason to just get in. My risk in my head was to 25 o/u but I got scared when it went to new highs and thought it could breakout at that point so I got out. Again, a what if scenario that fucked me. It had a failed breakdown, had a lower high which I tried to get into but didn't and it did have a nice wash. What I would have done afterwards is up in the air since it did take a while to actually break down and did look like a decent long if it did hold a higher low. It might have broken out had the entire sector not taken a shit. I did think about shorting it later in the day for more downside but decided against it since it felt like chasing/not a good entry. It would have worked had I done it but it's ok. The real reshort was after it failed at vwap and consolidated at a lower level but I was out during that time.

INSY: I was short biased on this due to this having similar news on July 5th and it gapping up, running, and then tanking the whole day. There was a high short interest so I kept that in mind too but overall I was pretty bearish. I shorted near the open when it looked to be basing slightly and could breakdown. It didn't and instead ripped higher so I stopped out. I didn't have a clear stop so that was a problem but I knew I wanted to get out. I then tried to reshort smaller size when I thought it stuffed and failed. Looking back it wasn't a real stuff but still it wasn't a bad entry and much better than the first attempt. I stopped out when it made new highs, which was the real stuff and almost top ticked it. I then said I wouldn't touch it until the main support broke. It did and I shorted in there with risk to .80 o/u. It screwed around and so I got out for a tiny loss on this position. It screwed around more but then the real setup appeared (besides the stuff) and I was out for that too. This goes to show you have to wait for your entry that you know you are good with and that's it. had I waited for the a stuff (or at least shorted where I tried the second time) I would have had a winner.

EXPR: I had this stock on watch due to it having relative weakness to other retailers for earnings/poor earnings/poor guidance. I wanted lower highs/stuff to get in. I let it do its thing at the open and I thought about getting in quickly but it was a good decision as it wicked around a whole lot and definitely would have gotten me out. I shorted when it had consolidation at the lows and looked good for continued downside. I then added on a lower high that peaked at the support of the consolidation area. I added near 12 for the breakdown, it didn't happen like I thought so I sized down to half which kept me in the position. I then said I won't add until it breaks and peaks 12. It broke 12 and came under and consolidated there so I shorted there but the way it looked - looking back it just held around there and didn't peak like usual. I ended up adding right as it was about to break back above 12 and so I got out of the add and got out of my whole position out of fear which was stupid. It then came back lower but never made new lows but I at least could have had a profit on the position. It did look like it reclaimed though so that is why I got out.

ACIA: I shorted this when it had consolidation at the lows and looked to go lower with the pattern it was forming. It went lower, peaked at the prior support so I added, it went lower but it had trouble breaking through 103 with conviction and while it had quotes on the level 2 for below 103, it just wouldn't go below it that much and when I saw it partially reclaiming on the 1min I got out. It could have been nothing and gone lower but this time it was something so I got out at a very good time. I thought about reshorting it later in the day but never did.

NYMX: I saw the news and of course thought about shorting it since a lot of these news plays have been dumped after they stuff and make lower highs. I kept an eye on it and I thought I missed the short after I saw it failing to break out from 3.40 on the level 2. But after it came back I thought it would have to stuff through it to get the real breakdown and that is what happened. I then shorted on the pop to 3.40 after that and covered into the immediate wash. I thought about holding but I know some of these do just stay around and this was one of them. I thought about reshorting but never did and I am glad I didn't. I thought about shorting it in the mid 4s but decided against it and I am glad for that too. It stuffed a few times before breaking out but the key was it kept holding so here is a reminder that just because something stuffs that doesn't mean it's the top and it also had a fake breakdown as well and recollected and held higher low before the breakout to 4s.

Things to remember:

1. A bunch of stuff from yesterday apply here as well.

2. A stuff may not be the top - it just most likely is.

3. Don't have FOMO and break your plan.

CLVS: I was short biased going into the day due to the news not being worth the huge gap and the fact that I thought a lot of longs would be bagged. I also thought that if I was a longterm short in this name I wouldn't bother covering yet just due to this news. My plan was if I saw any stuffs/lower highs to get in and it wasn't something I was willing to average into due to the fact that it could just keep going higher in case a squeeze was on. I entered my position prematurely and partly due to FOMO and broke my rules for my plan by going in when vwap was looking to be the peak at the open, which is definitely not a reason to just get in. My risk in my head was to 25 o/u but I got scared when it went to new highs and thought it could breakout at that point so I got out. Again, a what if scenario that fucked me. It had a failed breakdown, had a lower high which I tried to get into but didn't and it did have a nice wash. What I would have done afterwards is up in the air since it did take a while to actually break down and did look like a decent long if it did hold a higher low. It might have broken out had the entire sector not taken a shit. I did think about shorting it later in the day for more downside but decided against it since it felt like chasing/not a good entry. It would have worked had I done it but it's ok. The real reshort was after it failed at vwap and consolidated at a lower level but I was out during that time.

INSY: I was short biased on this due to this having similar news on July 5th and it gapping up, running, and then tanking the whole day. There was a high short interest so I kept that in mind too but overall I was pretty bearish. I shorted near the open when it looked to be basing slightly and could breakdown. It didn't and instead ripped higher so I stopped out. I didn't have a clear stop so that was a problem but I knew I wanted to get out. I then tried to reshort smaller size when I thought it stuffed and failed. Looking back it wasn't a real stuff but still it wasn't a bad entry and much better than the first attempt. I stopped out when it made new highs, which was the real stuff and almost top ticked it. I then said I wouldn't touch it until the main support broke. It did and I shorted in there with risk to .80 o/u. It screwed around and so I got out for a tiny loss on this position. It screwed around more but then the real setup appeared (besides the stuff) and I was out for that too. This goes to show you have to wait for your entry that you know you are good with and that's it. had I waited for the a stuff (or at least shorted where I tried the second time) I would have had a winner.

EXPR: I had this stock on watch due to it having relative weakness to other retailers for earnings/poor earnings/poor guidance. I wanted lower highs/stuff to get in. I let it do its thing at the open and I thought about getting in quickly but it was a good decision as it wicked around a whole lot and definitely would have gotten me out. I shorted when it had consolidation at the lows and looked good for continued downside. I then added on a lower high that peaked at the support of the consolidation area. I added near 12 for the breakdown, it didn't happen like I thought so I sized down to half which kept me in the position. I then said I won't add until it breaks and peaks 12. It broke 12 and came under and consolidated there so I shorted there but the way it looked - looking back it just held around there and didn't peak like usual. I ended up adding right as it was about to break back above 12 and so I got out of the add and got out of my whole position out of fear which was stupid. It then came back lower but never made new lows but I at least could have had a profit on the position. It did look like it reclaimed though so that is why I got out.

ACIA: I shorted this when it had consolidation at the lows and looked to go lower with the pattern it was forming. It went lower, peaked at the prior support so I added, it went lower but it had trouble breaking through 103 with conviction and while it had quotes on the level 2 for below 103, it just wouldn't go below it that much and when I saw it partially reclaiming on the 1min I got out. It could have been nothing and gone lower but this time it was something so I got out at a very good time. I thought about reshorting it later in the day but never did.

NYMX: I saw the news and of course thought about shorting it since a lot of these news plays have been dumped after they stuff and make lower highs. I kept an eye on it and I thought I missed the short after I saw it failing to break out from 3.40 on the level 2. But after it came back I thought it would have to stuff through it to get the real breakdown and that is what happened. I then shorted on the pop to 3.40 after that and covered into the immediate wash. I thought about holding but I know some of these do just stay around and this was one of them. I thought about reshorting but never did and I am glad I didn't. I thought about shorting it in the mid 4s but decided against it and I am glad for that too. It stuffed a few times before breaking out but the key was it kept holding so here is a reminder that just because something stuffs that doesn't mean it's the top and it also had a fake breakdown as well and recollected and held higher low before the breakout to 4s.

Things to remember:

1. A bunch of stuff from yesterday apply here as well.

2. A stuff may not be the top - it just most likely is.

3. Don't have FOMO and break your plan.

Trading Recap 8/23/16

Tuesday was a testament to proper trading. The key was to not have FOMO, trade the best stocks, wait for a pattern you like, and then execute and add to the winner.

MON: I saw it had news that it was advancing talks for a takeover with Bayer. It seemed like rehashed news to me and that the gap wasn't worth it and that buyers would sell after no followthrough. I thought about getting in before it broke below the premarket support but decided to wait because I wasn't very, very confident on this trade but I was confident enough that I had it on top watch. After it broke below support I went in small and then added on continuation because I really did like the setup. It did flush a bit lower but then held up a little. At this point I figured it could come back and go higher and I wasn't sure so I did downsize and take half of the position off for small profits. After it seemed like it was holding up I took off the rest since I wanted to lock in. It did go back a bit and if I was in I might have downsized at the highs. I decided to reshort 1/4 size at the retest and I wish I had my 1/2 size for the real wash but so be it. I covered when the whole number was holding for a nice gain. The rest of the time was just reshorts based on level 2 which didn't work but I was testing to see if it worked - basically the bid was absorbing so I tried shorting when it stopped and the bid went slightly below. I ended up covering at the highs due to panic (as usual) but later on I reshorted because it had a good pattern and it worked although it was on smaller size due to reduced confidence in the trade but profits are profits. Overall I traded it well. One thing to discuss is the covering of the first trade before it retested and ultimately went lower. On one hand I overall didn't have the biggest confidence in the trade since I just had a hunch (that ended up working well) so there was that reason for covering when I did. On the other hand it never invalidated my stop of .50 o/u. I will have to think about this but it also depends on how confident I am in the setup as well. I definitely would not have covered if I was a lot more confident.

BBY: I had this on watch due to strong earnings/guidance/high short interest. I thought it would have to funnel out any profit takers and reclaim/higher lows for me to long off of. It did exactly that and after having a false breakdown it reclaimed and had higher lows. I longed a small position and then added when it held a higher level. I did try to add more but pussied out/didn't get filled. I did end up selling too soon and it did hold a nice trend. My plan for selling was to wait until it sped up past the trend line or until it broke it. It started speeding up a little and I just decided to get out - right before the huge push and real speedup happened. Next time I'll know to wait though. I thought about going long for the breakout since it was holding up towards the close but decided to just wait until it potentially broke the resistance since I didn't want to get stuck in the chop.

Things to keep in mind:

1. Wait for the setup and don't trade right at the open unless you are very certain of it.

2. Trade different sizes for stocks you are more confident about.

3. Remember to truly respect your stops and don't half ass it like "oh it went higher I'll get out". Really think about it.

4. On great looking stocks like BBY don't be afraid to add in more.

5. Don't panic and stop out at top or bottom like usual. Never yet has the "what if?" scenario you envision in your head come true.

MON: I saw it had news that it was advancing talks for a takeover with Bayer. It seemed like rehashed news to me and that the gap wasn't worth it and that buyers would sell after no followthrough. I thought about getting in before it broke below the premarket support but decided to wait because I wasn't very, very confident on this trade but I was confident enough that I had it on top watch. After it broke below support I went in small and then added on continuation because I really did like the setup. It did flush a bit lower but then held up a little. At this point I figured it could come back and go higher and I wasn't sure so I did downsize and take half of the position off for small profits. After it seemed like it was holding up I took off the rest since I wanted to lock in. It did go back a bit and if I was in I might have downsized at the highs. I decided to reshort 1/4 size at the retest and I wish I had my 1/2 size for the real wash but so be it. I covered when the whole number was holding for a nice gain. The rest of the time was just reshorts based on level 2 which didn't work but I was testing to see if it worked - basically the bid was absorbing so I tried shorting when it stopped and the bid went slightly below. I ended up covering at the highs due to panic (as usual) but later on I reshorted because it had a good pattern and it worked although it was on smaller size due to reduced confidence in the trade but profits are profits. Overall I traded it well. One thing to discuss is the covering of the first trade before it retested and ultimately went lower. On one hand I overall didn't have the biggest confidence in the trade since I just had a hunch (that ended up working well) so there was that reason for covering when I did. On the other hand it never invalidated my stop of .50 o/u. I will have to think about this but it also depends on how confident I am in the setup as well. I definitely would not have covered if I was a lot more confident.

BBY: I had this on watch due to strong earnings/guidance/high short interest. I thought it would have to funnel out any profit takers and reclaim/higher lows for me to long off of. It did exactly that and after having a false breakdown it reclaimed and had higher lows. I longed a small position and then added when it held a higher level. I did try to add more but pussied out/didn't get filled. I did end up selling too soon and it did hold a nice trend. My plan for selling was to wait until it sped up past the trend line or until it broke it. It started speeding up a little and I just decided to get out - right before the huge push and real speedup happened. Next time I'll know to wait though. I thought about going long for the breakout since it was holding up towards the close but decided to just wait until it potentially broke the resistance since I didn't want to get stuck in the chop.

Things to keep in mind:

1. Wait for the setup and don't trade right at the open unless you are very certain of it.

2. Trade different sizes for stocks you are more confident about.

3. Remember to truly respect your stops and don't half ass it like "oh it went higher I'll get out". Really think about it.

4. On great looking stocks like BBY don't be afraid to add in more.

5. Don't panic and stop out at top or bottom like usual. Never yet has the "what if?" scenario you envision in your head come true.

Monday, August 22, 2016

Trading Recap 8/22/16

A losing day for me and while there were some trading issues, overall my process and trading were ok. Always room for improvement though.

SPHS: I was short biased due it gapping up in sympathy to the Pfizer acquisition and everyone seemed bullish on it on stocktwits so that made me more short biased as well. I was looking for a move higher/stuffs to get short but unfortunately that didn't happen. It did seem to stuff out of the gate so I got interested then. It was under vwap and while it was a definite I got in with small size and I was willing to add higher on a proper entry such as a stuff. So I shorted small size (while it was towards the bottom of the candle I waited until it looked like it peaked vwap and got right in) and then got an immediate wash with big volume. Unfortunately I had small size and I did think it could go lower as a bigger picture idea but the big volume and flush did get me thinking that that was it. I wanted to add on a retest of the r/g level but missed that entry so when it was consolidating near the lows I added in because it did look like it could go lower. I then added in full size (too soon) because it went a little lower and that ended up being it. It then started to reverse and I decided to get out of all my shares within a few minutes because I figured that was really it with the flush when there was no more immediate downside. So overall the thesis and such was ok but the adding and not just taking the flush screwed me. You can't impose your will on the market - if you get the move with only partial size then just take it and don't try to force another trade on it. You should have taken the profits and then you could have reshorted after taking profits to see if it would go lower or just not have done anything else with it.

CXW: I was bullish on this stock compared to GEO due to the insider buys that this one had compared to the sells GEO had and any pattern of higher lows/reclaiming I would be interested in. I went long after it looked to have washed out and then reclaimed vwap. I started in on a dip to vwap and was going to give it to the lows. It ended up coming right back down and I sold it right at the lows. While I didn't let it test and break the lows, I figured I could always get back in if it did work and I thought it would work start to work right away. It did end up flushing below the lows and it came back and reclaimed vwap. This pattern looked interesting to me so I went long again and it did break higher this time. However, I wanted a dip back to the 60s to add and it just went through to the 70s without any rest. When it held a higher low I just got in and added where it ended up being the top unfortunately. When it didn't have any followthrough and GEO was going up at the same time (I picked the wrong stock to go long - the one no one thought would go up did go up - go figure) CXW wasn't doing anything so I just got out and I was overall at a tiny loss on the name. While I could have bought the washouts, I wasn't looking for a washout type of play but I wanted it to prove itself first. However, I should have given it more time since it didn't do much at the open as far as prove itself. The ways I would have improved this trade was to wait for better confirmation of trend and not add and get partial FOMO.